Facing the current Challenges

In Nigeria, we have recognized that lenders and borrowers face significant obstacles in the traditional loan approval process. Some of these obstacles includes:

4 months

(Dec 2024 - Mar 2025)

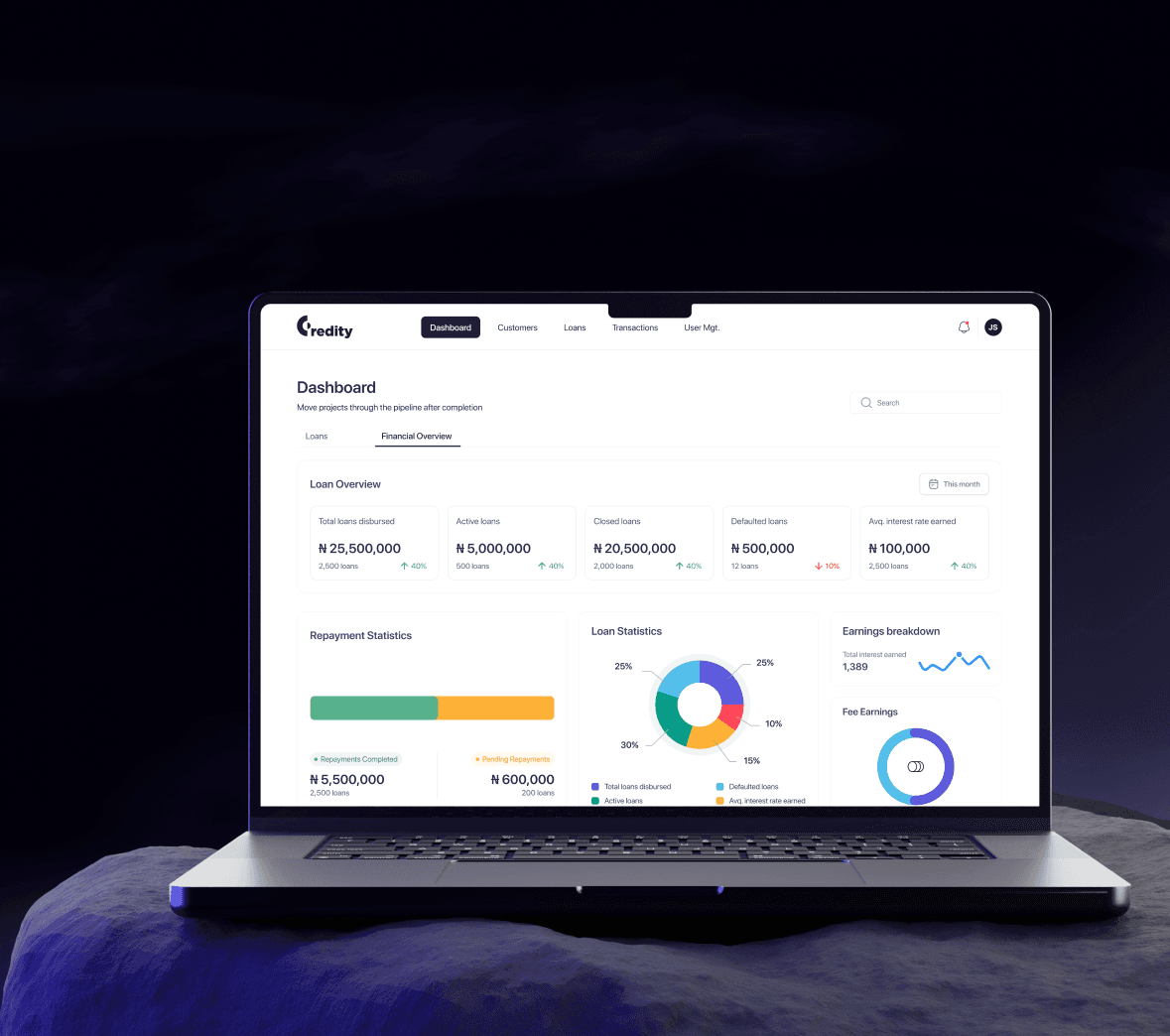

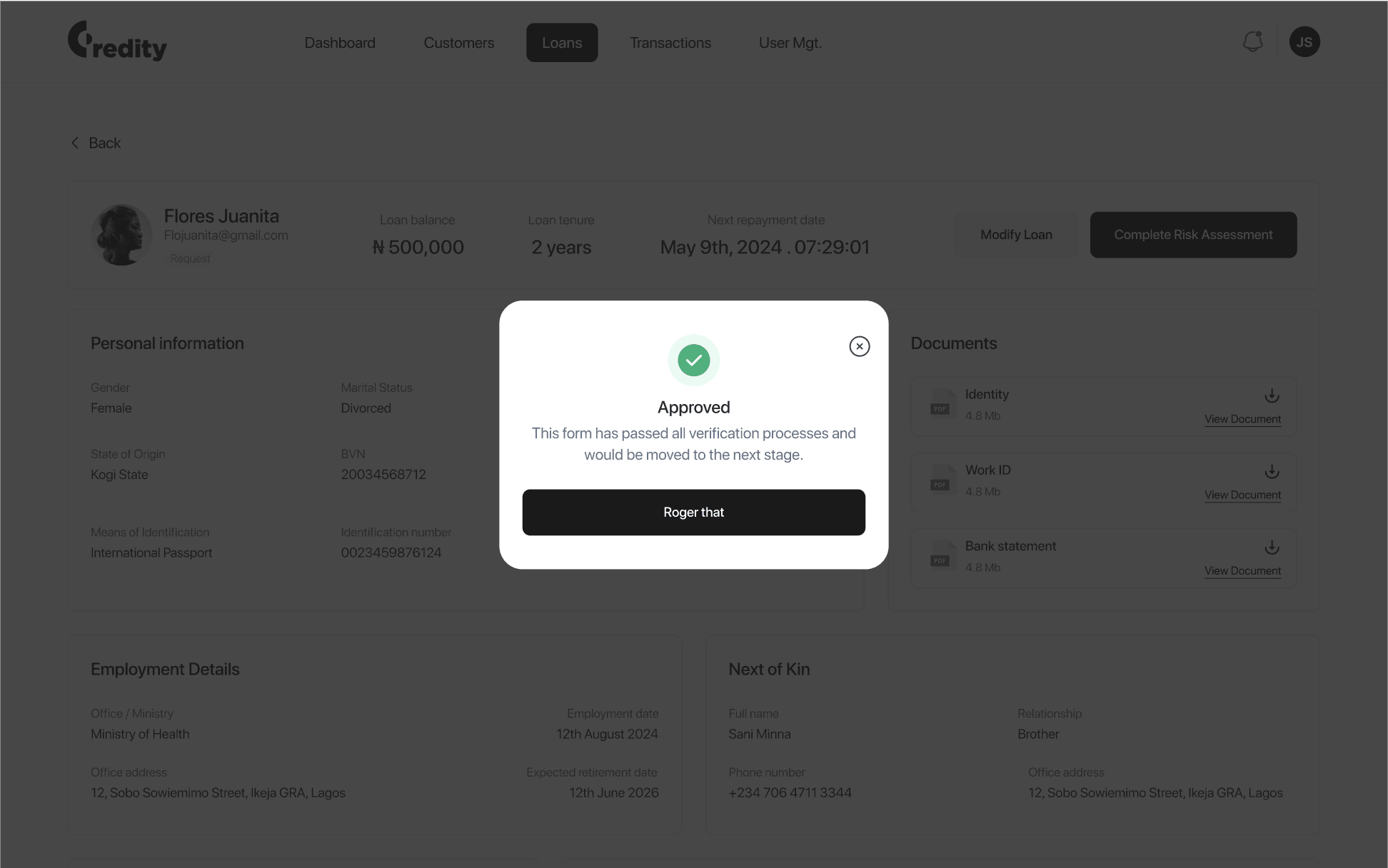

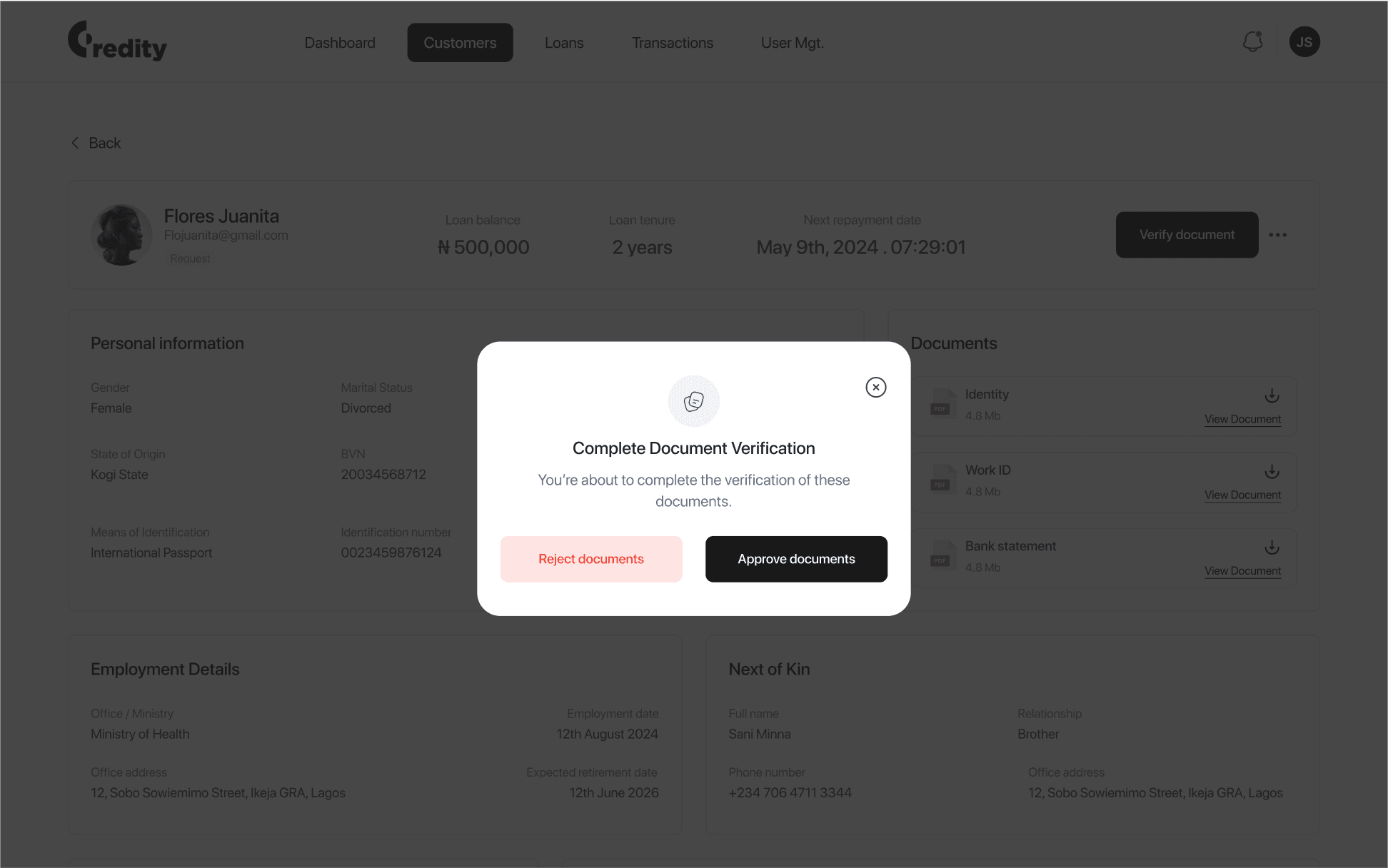

Creditty is a loan management platform designed to streamline the lending process for Nigerian civil servants by leveraging automation and real-time data insights, setting it apart from traditional lending platforms that rely on manual processing and generic credit assessments.

By automating loan approvals, repayment deductions, and risk assessments, Creditty enables lenders to provide loans efficiently and securely. With a seamless, data-driven system, the platform reduces default risks and improves access to credit for civil servants.

80%

reduction

in loan default rates due to automated salary deductions.

50%

faster

loan approvals through streamlined digital processes.

70%

increase

in lender efficiency, allowing for portfolio expansion.

In Nigeria, we have recognized that lenders and borrowers face significant obstacles in the traditional loan approval process. Some of these obstacles includes:

1

High Default Risks: Inefficient repayment collection led to high default rates, making lending riskier.

2

Limited Borrower Financial Visibility: Lenders struggled to assess borrowers’ financial histories accurately.

3

Slow and Manual Loan Approvals: Paper-based and manual verification processes delayed loan disbursement.

4

Scaling Challenges for Lenders: Expanding loan portfolios was difficult without automation.

The challenge was to create a platform that addresses these obstacles that we’ve identified in the loan industry and execute it perfectly.

So how do we intend to solve this problem in our design? How should we make the experience seamless and easy for both the lenders and borrowers to use without getting frustrated?

Analyzing the market, automating the process of generating loan was crucial and the preferred way to go in order to combat these obstacles encountered.

Nigerian Lending Market Size: Over ₦10 trillion ($22 billion) in consumer credit annually.

Civil Servant Population: More than 2 million federal and state workers in Nigeria.

Banking Penetration: Over 70% of civil servants receive salaries through banks, making automated deductions feasible.

High Loan Demand: Civil servants rely on credit for emergencies, housing, and business investments.

User research and interviews were conducted, we identified key pain points by employing a combination of surveys, and one-on-one interviews. This was to understand their financial behavior and loan application struggles. Additionally, stakeholder interviews with microfinance banks provided insights into lender challenges.

I came up with a persona to better understand our target audience.

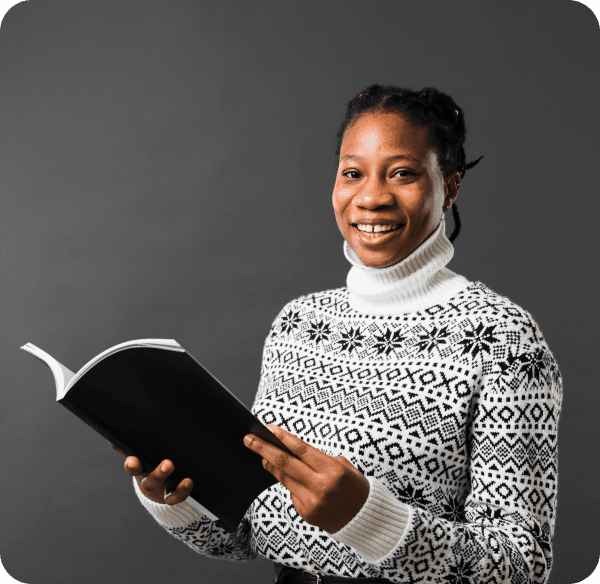

The Borrower

Grace Okonkwo

📍 Enugu, Nigeria | 💼 Public School Teacher

Grace is a dedicated public school teacher who’s been serving her community for over a decade. As the sole provider for her aging parents and two children, unexpected expenses like hospital bills or school fees often push her finances to the edge. She needs a loan platform that doesn’t require endless paperwork or long waiting times. For Grace, transparency and speed are not just conveniences, they are lifelines.

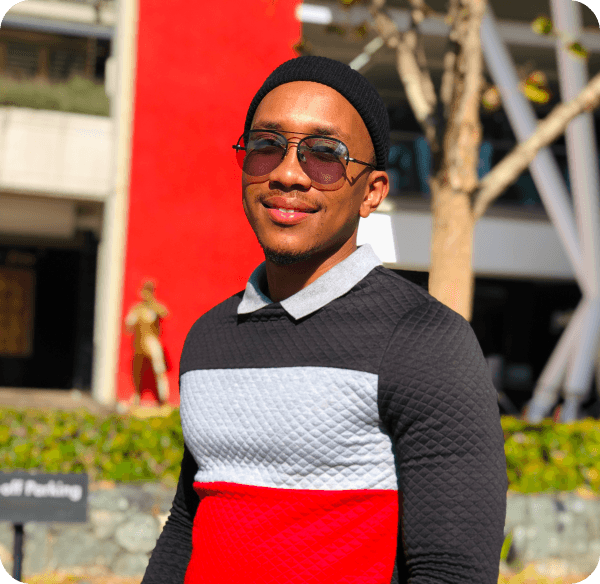

The Lender

Tunde Bamidele

📍 Ibadan, Nigeria | 💼 Loan Officer at Local Microfinance Bank

Tunde is a seasoned loan officer who manages hundreds of loan applications each month. His goal is to help more civil servants access funds, but he’s constantly bottlenecked by manual processes and outdated tools. He spends hours verifying documents and tracking repayment manually, which slows down operations and increases the risk of default.

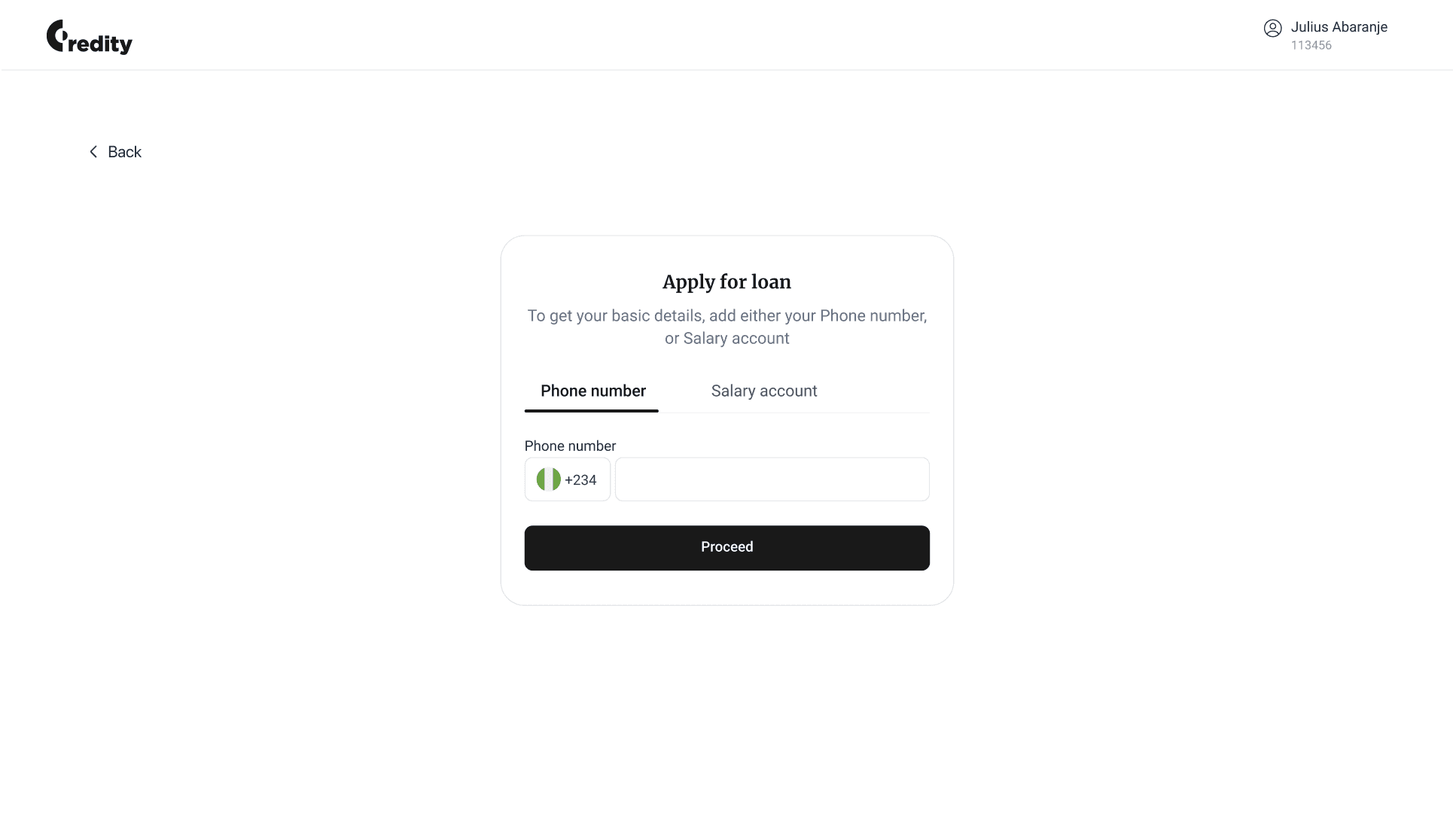

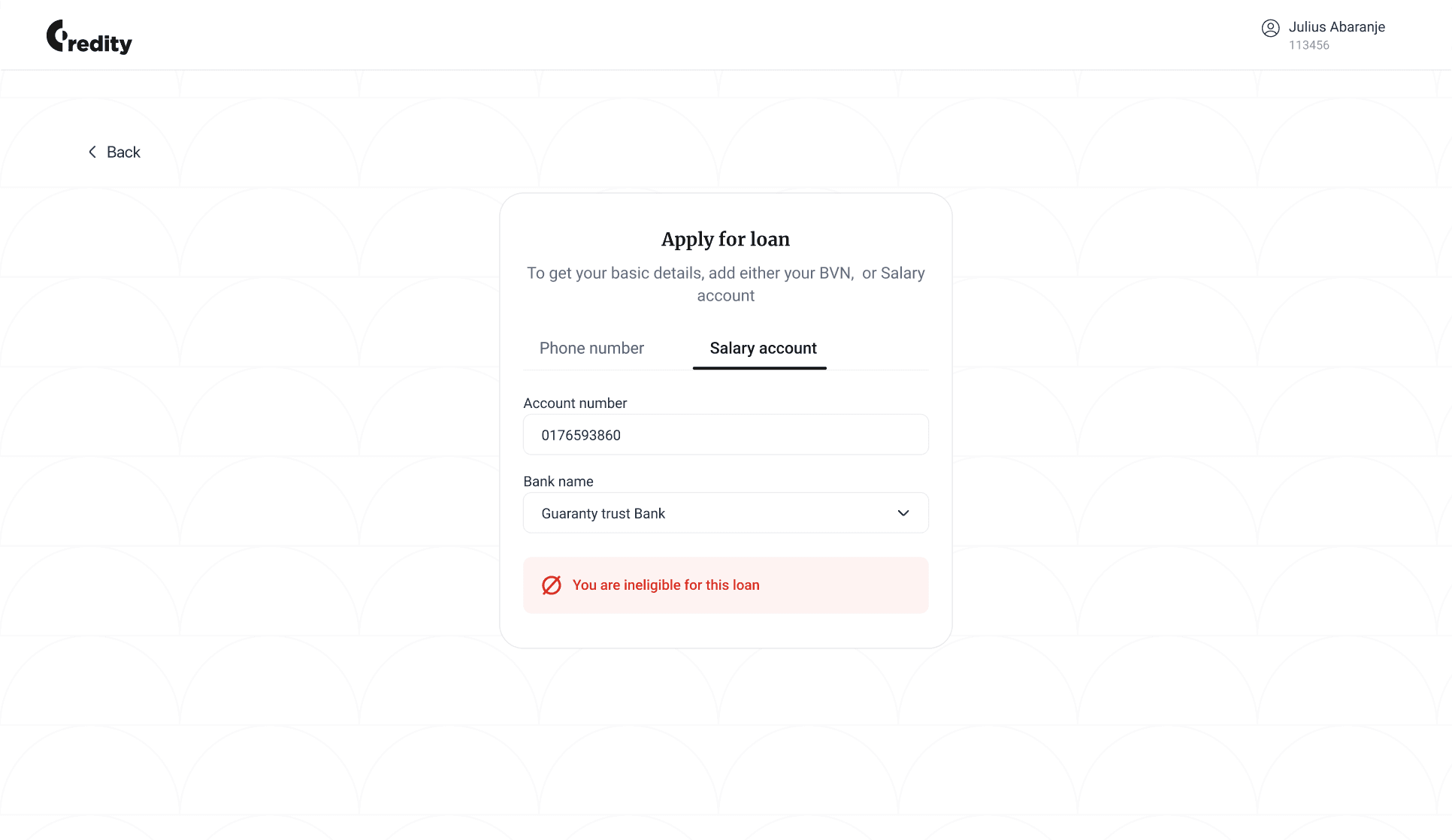

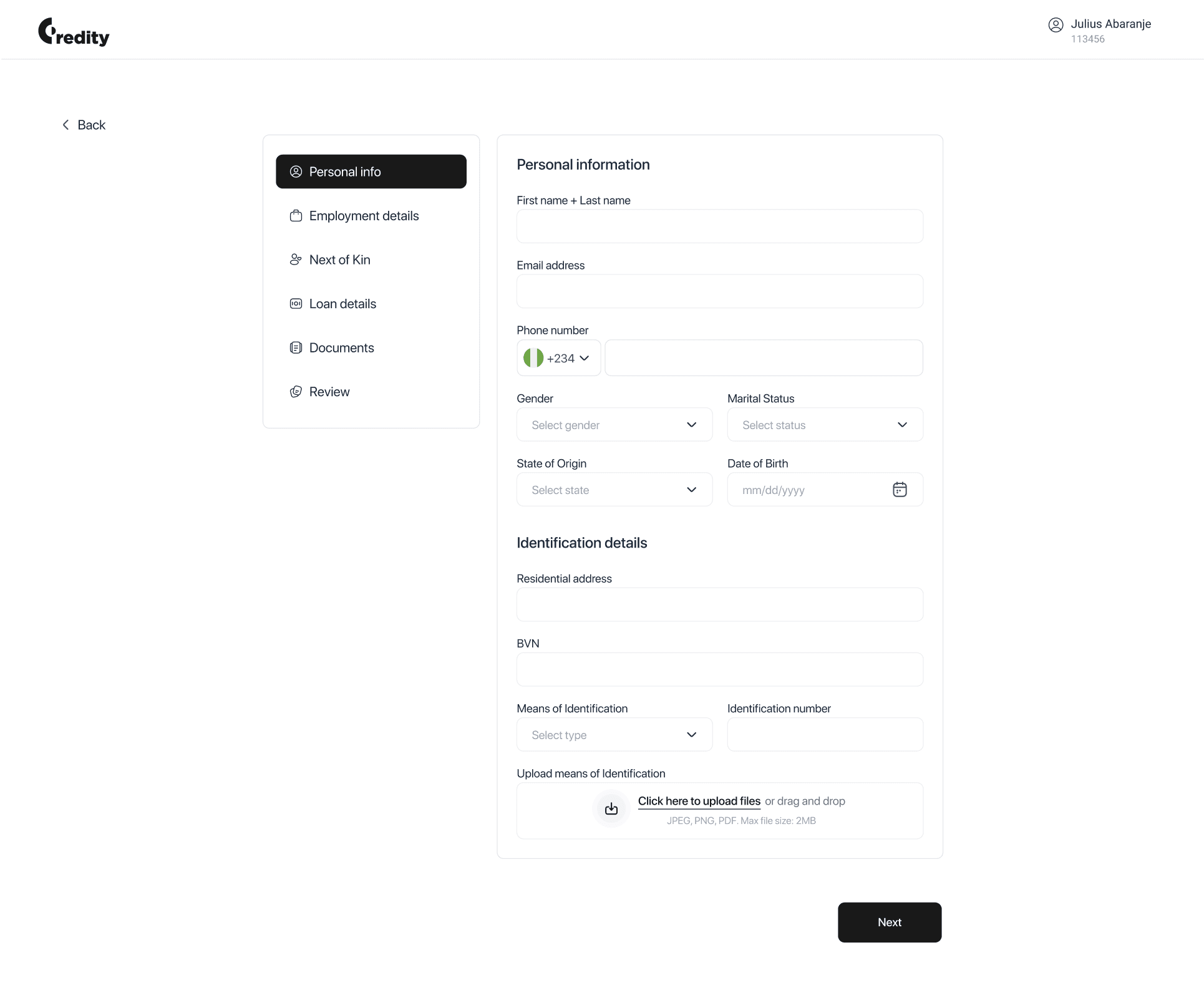

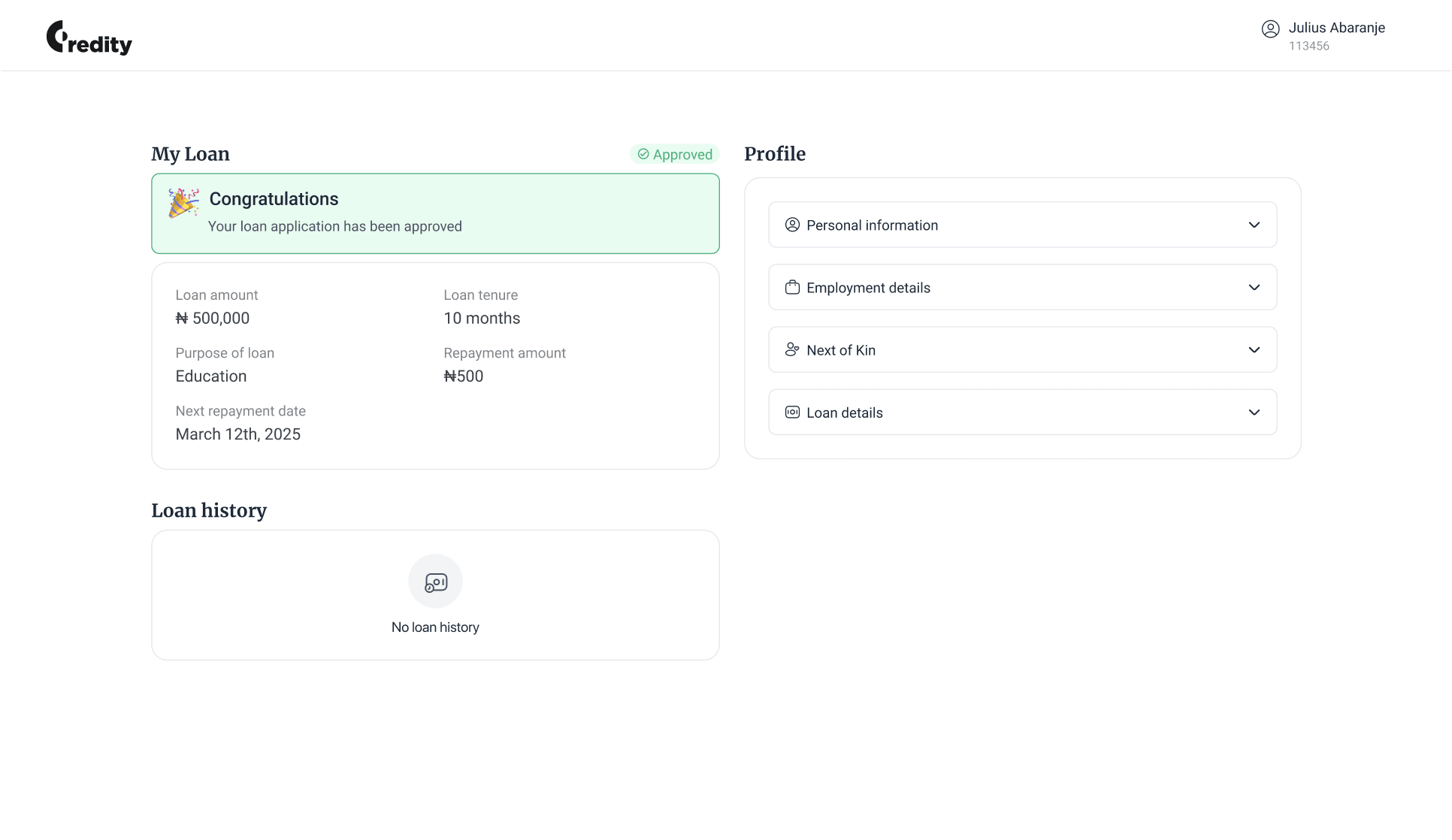

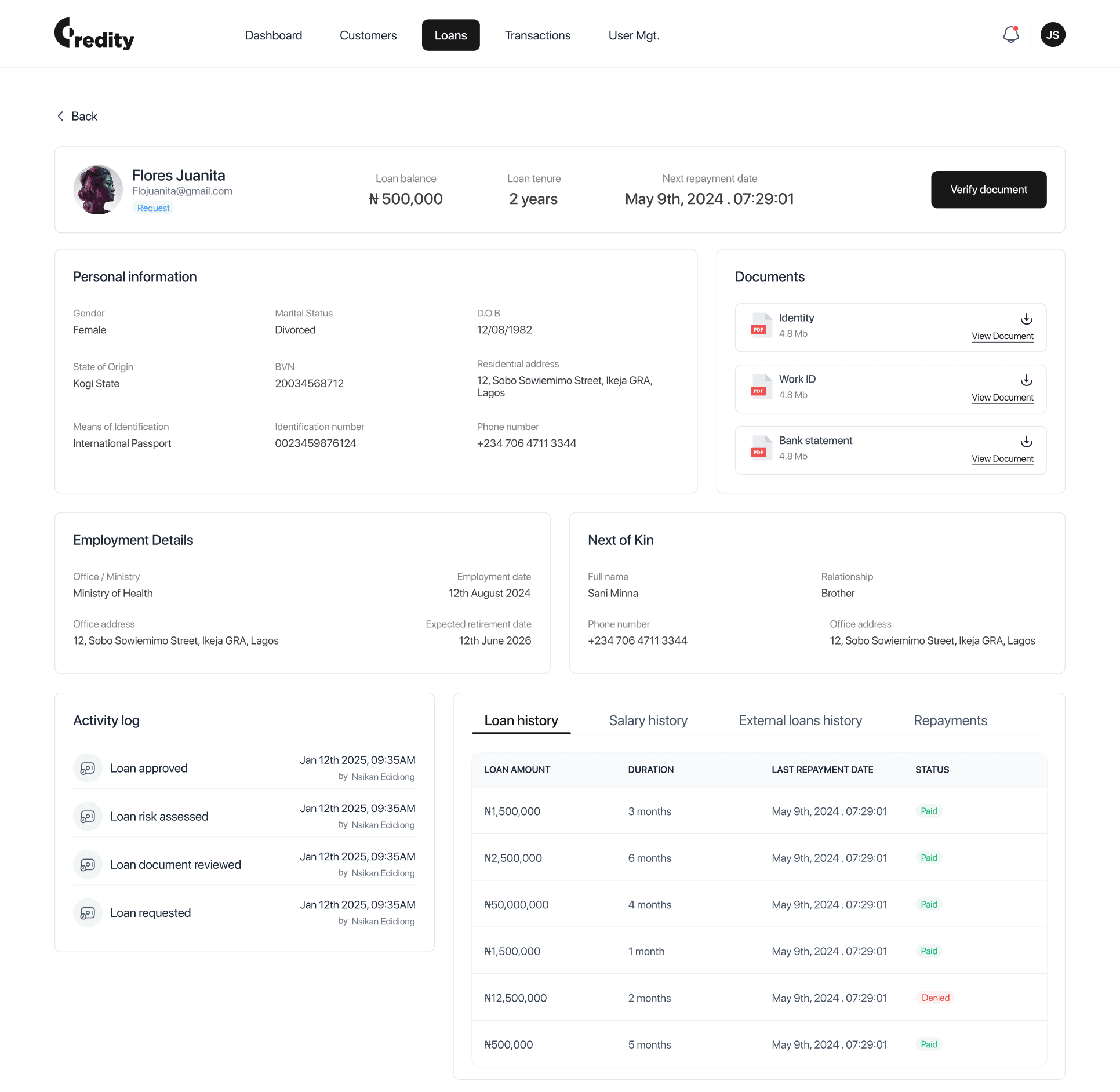

A simple, intuitive interface for civil servants to apply for loans in minutes. Instant verification and eligibility assessment.

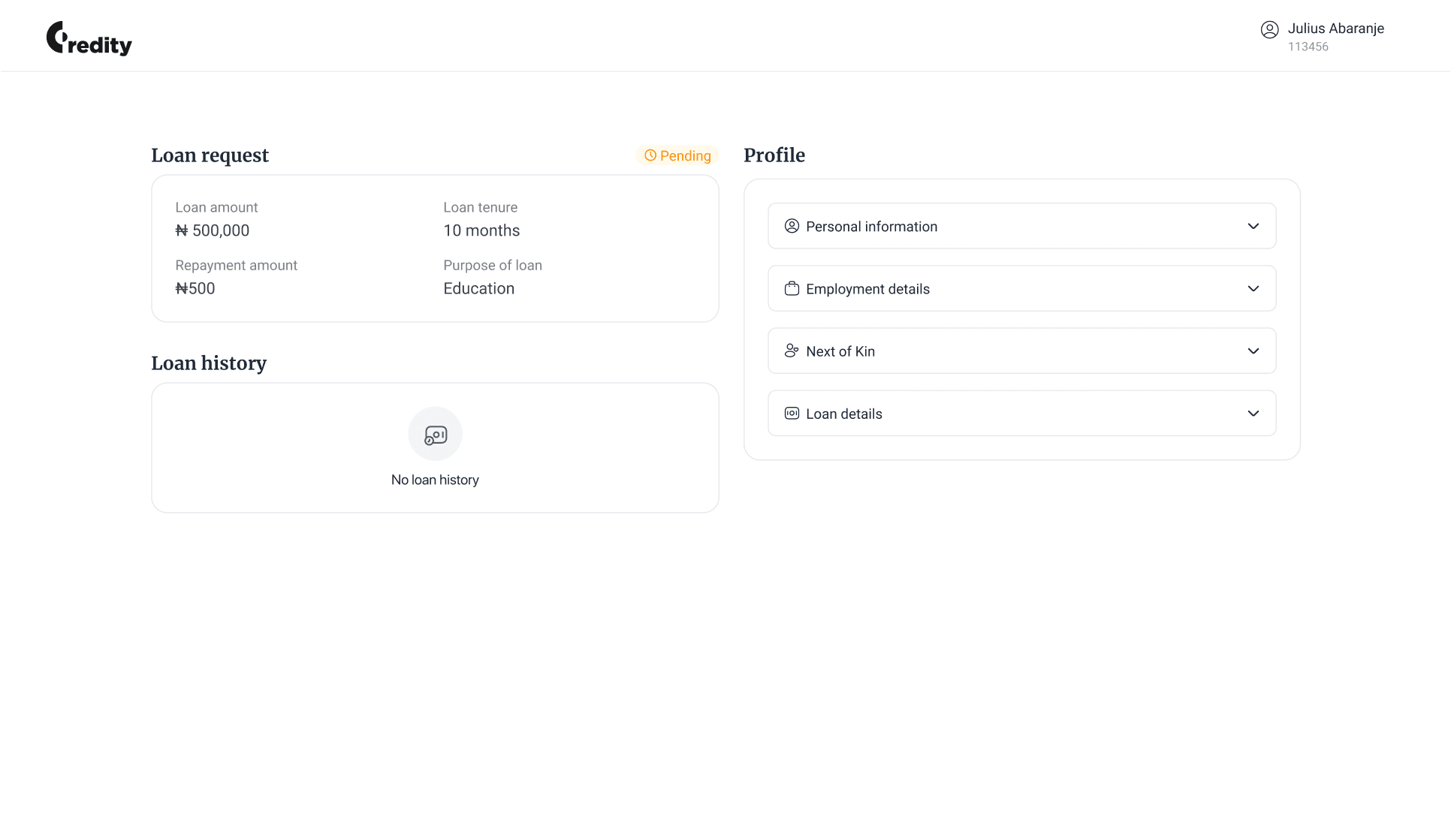

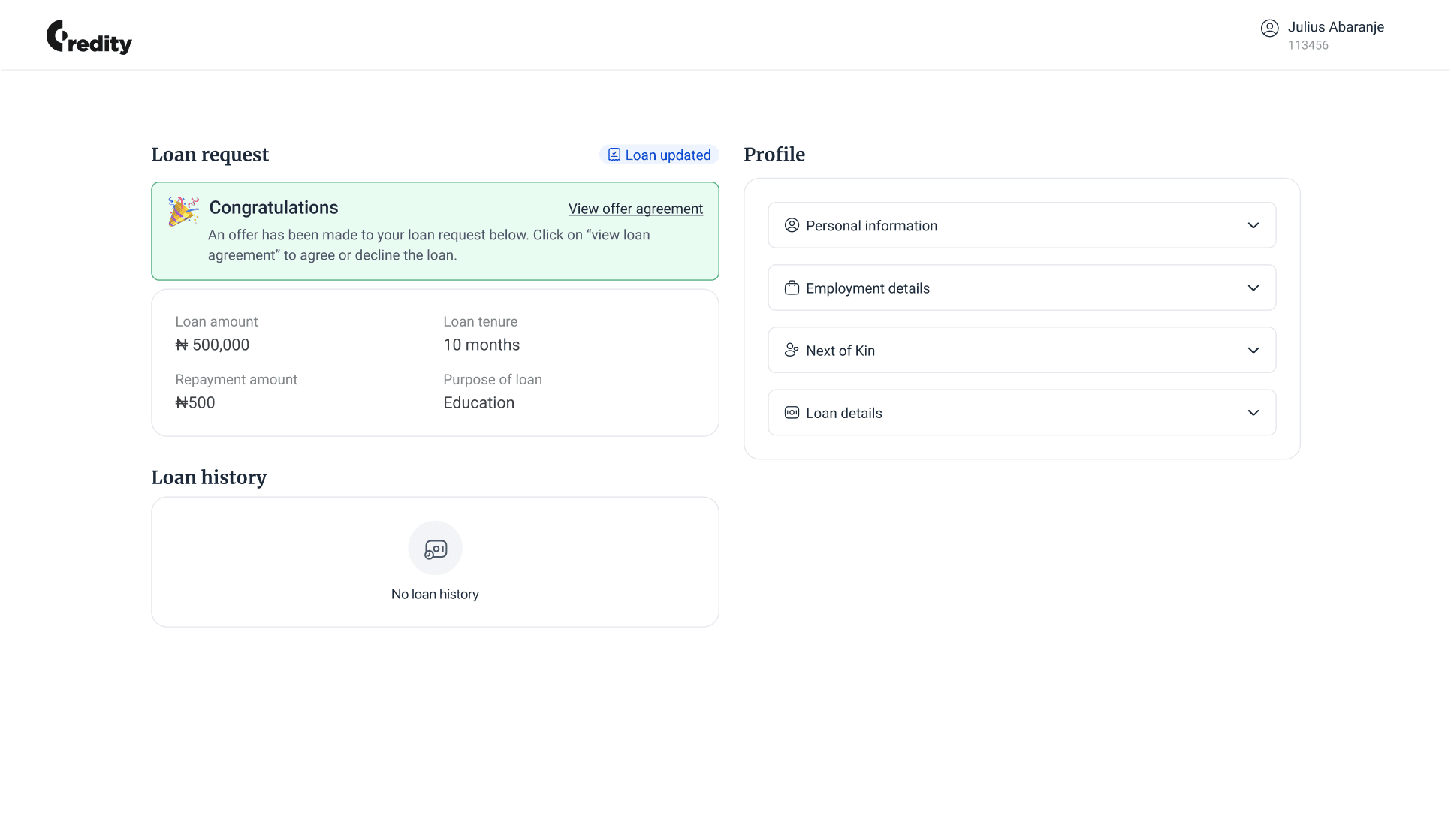

This Displays real-time loan request and statuses. Offer agreement can be made to loans for the lenders to either accept or decline.

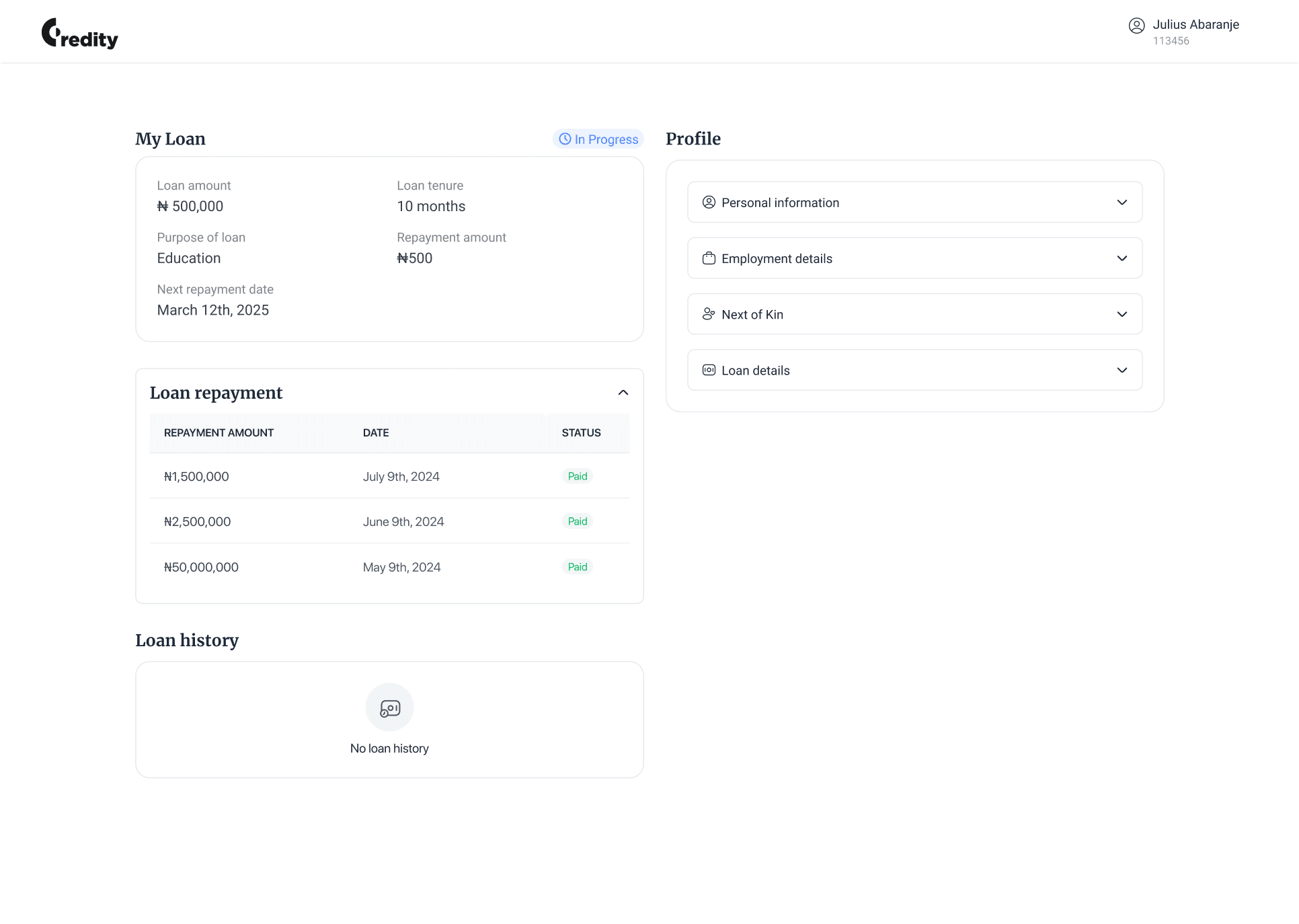

Loan repayment is automatic and is easily deducted from the lenders account details. Lenders can see the details of amount that was deducted monthly.

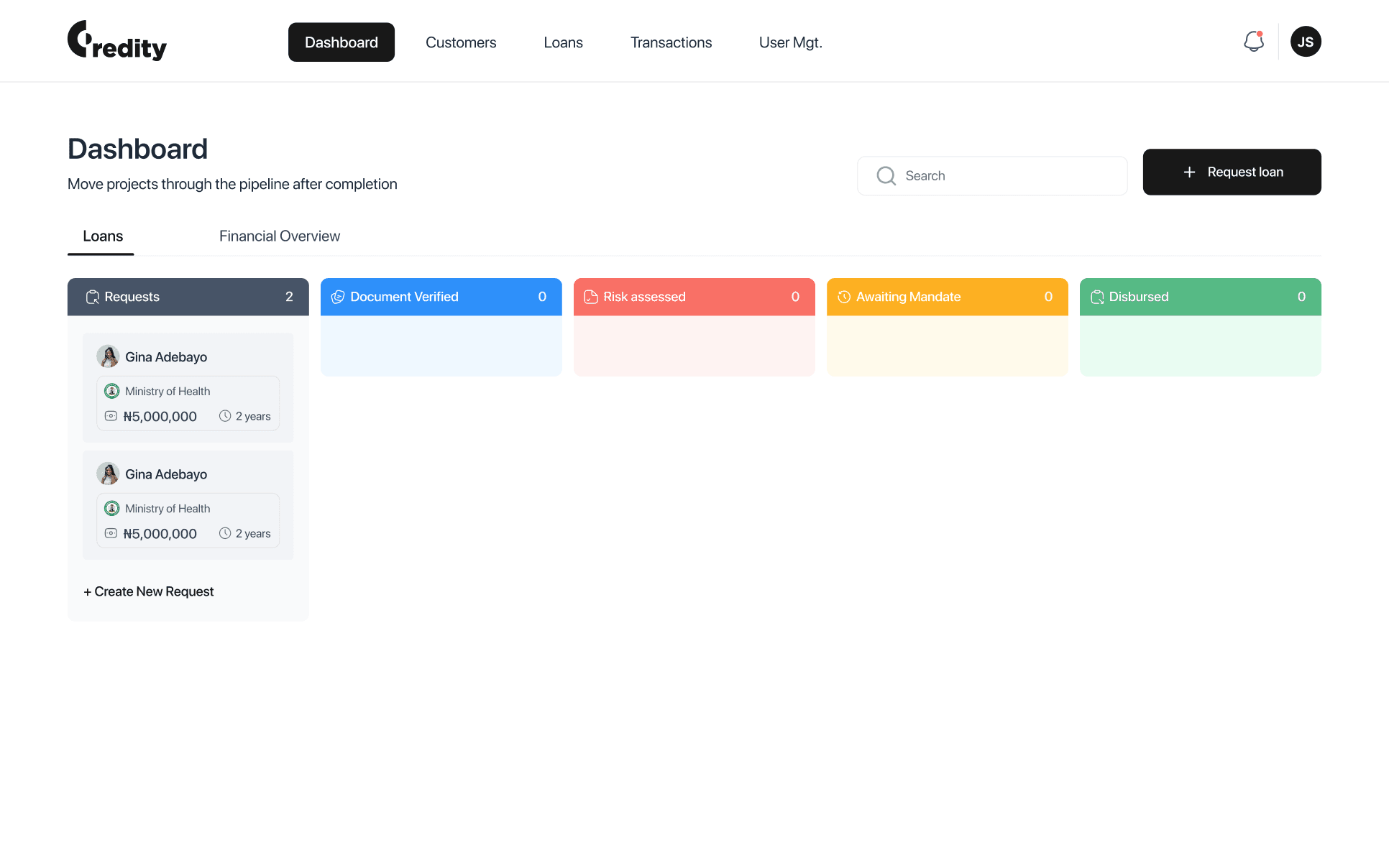

Kanban-style board for tracking approvals and rejections, a method commonly used in workflow management but uniquely tailored in Creditty for easy loan processing. They also get automated background checks for swift decision-making.

Creditty has revolutionized lending for Nigerian civil servants by addressing key inefficiencies in traditional loan processes.

By leveraging automation, real-time analytics, and payroll integration, it stands out as a leading loan management platform, benefiting both lenders and borrowers alike.

Need a designer?

If you want to collaborate or design a project, you can book a call with me or reach out to me on any of my socials