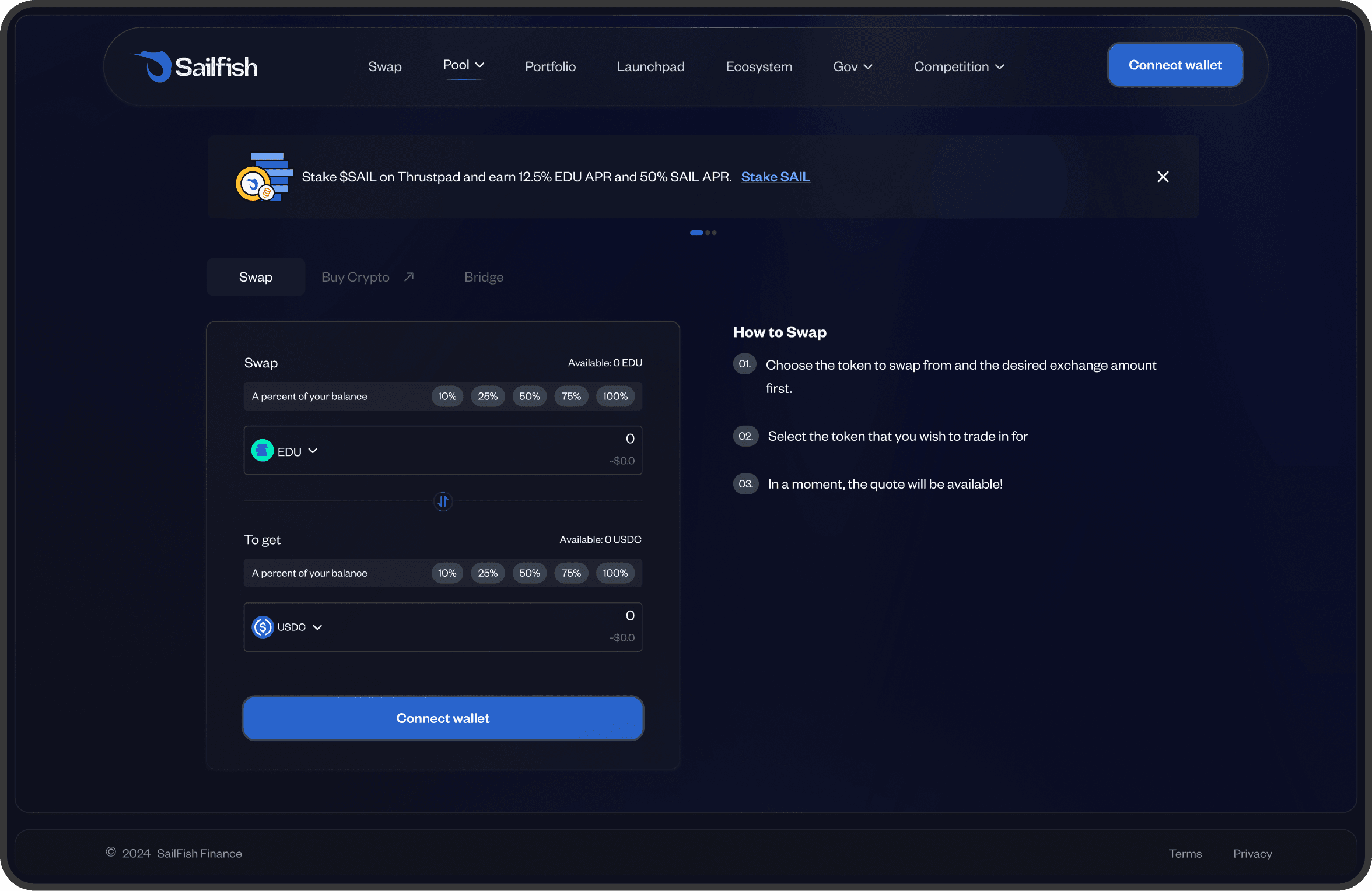

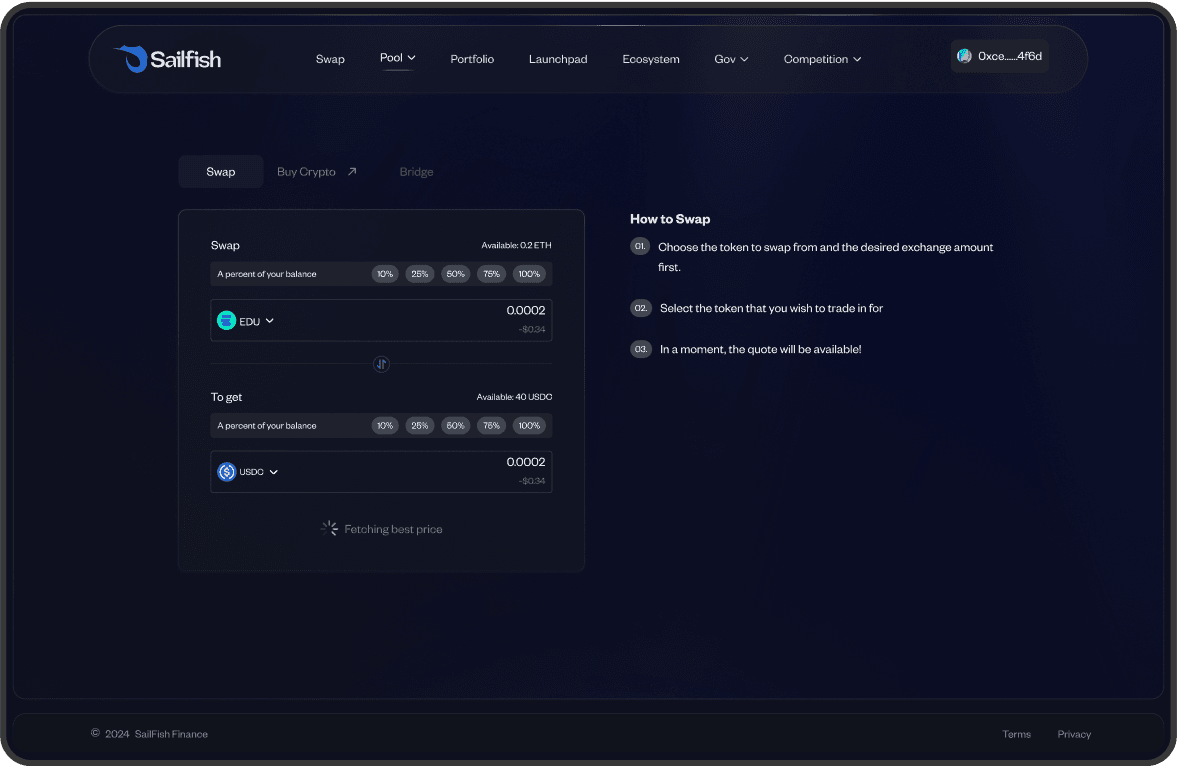

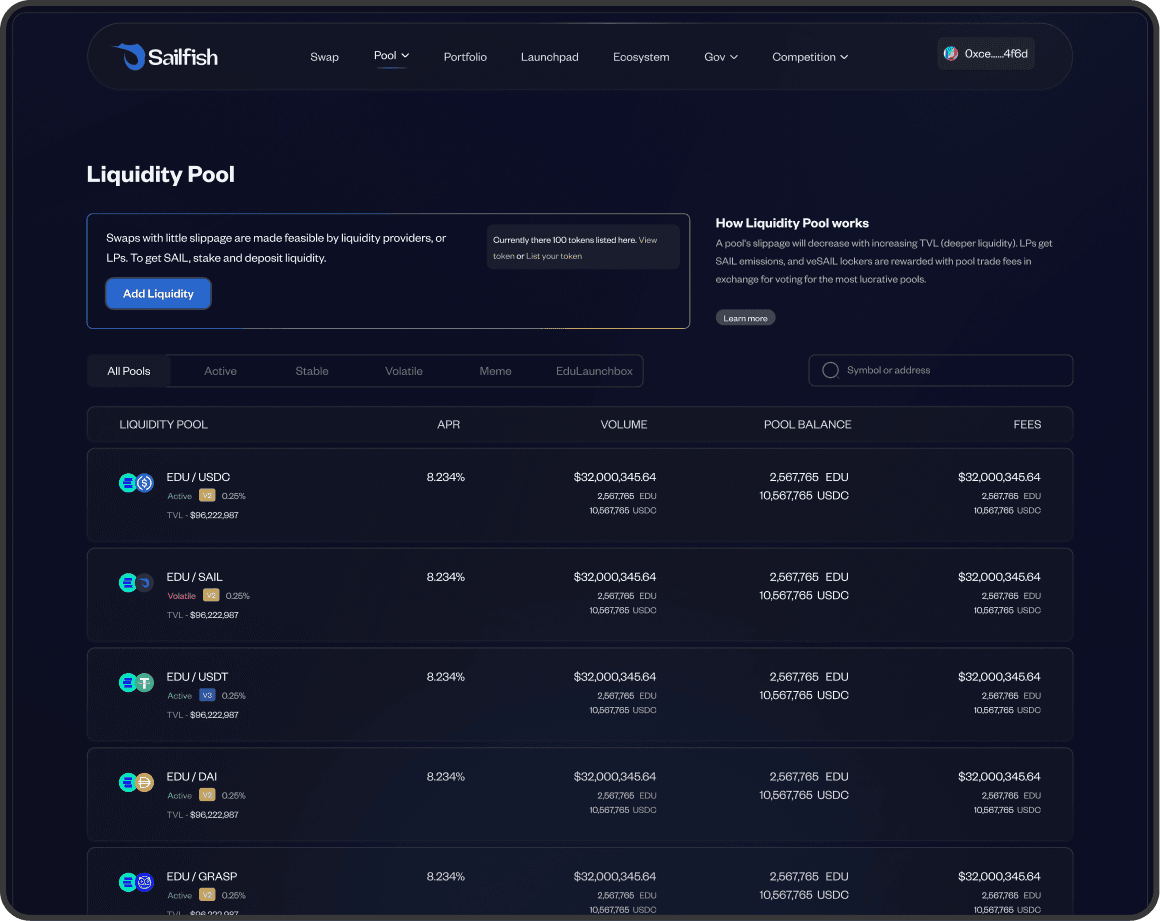

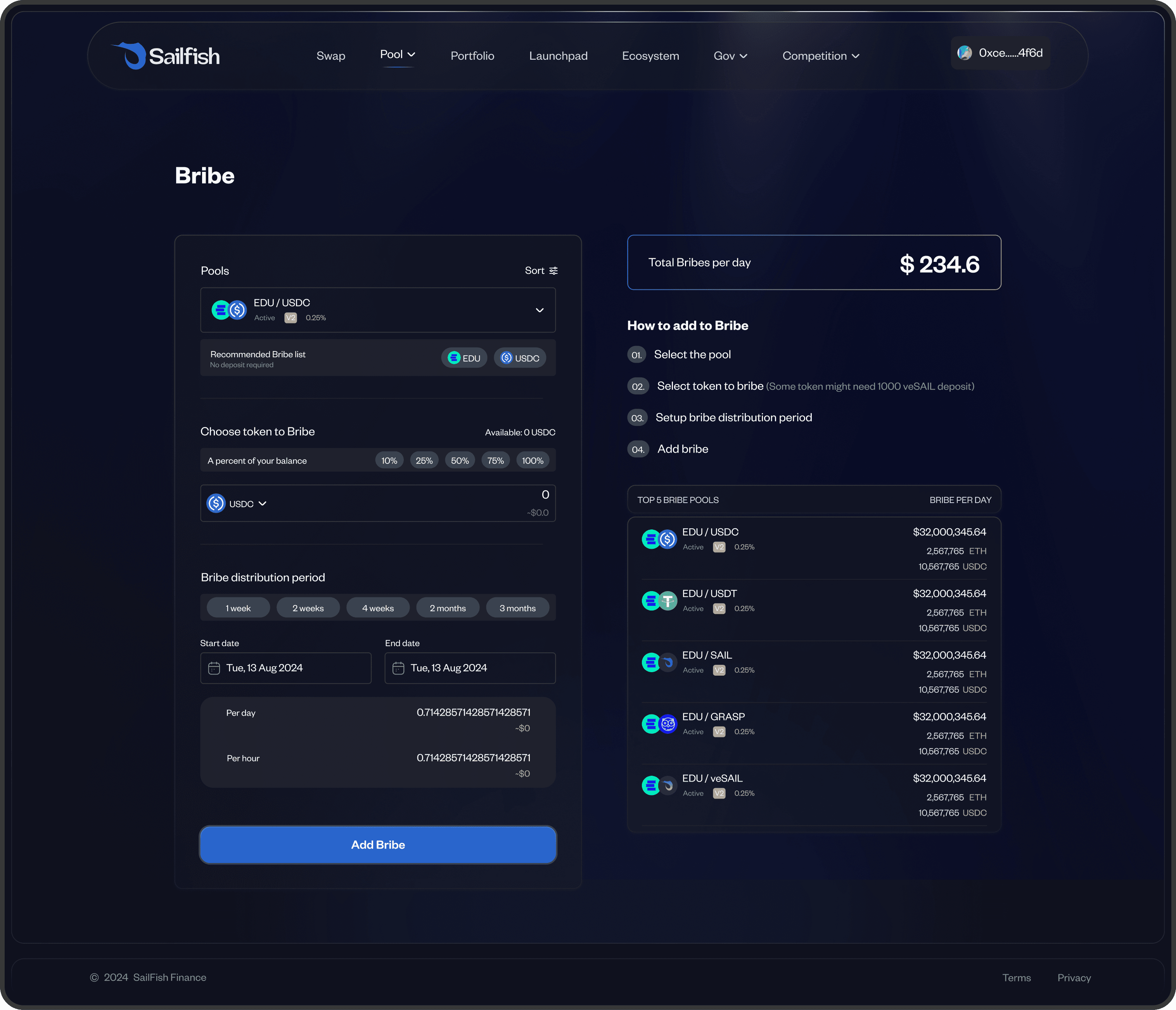

Structuring the Experience

To ensure SailFish was optimized for user needs, we conducted:

- 📌 Competitive Analysis of existing veDEX platform

- 📌 User Interviews with liquidity providers, traders & protocol owners

- 📌 Behavioral Analysis of early Educhain DeFi participants